This article first appeared in The Edge Malaysia Weekly on October 22, 2018 - October 28, 2018

THE Malaysian Anti-Corruption Commission (MACC) has started investigating if any wrongdoing was committed by Datuk Seri Najib Razak in agreeing to settle a dispute with Abu Dhabi’s International Petroleum Investment Company (IPIC) over a missing sum of US$3.5 billion.

Najib, who is already facing several charges over 1Malaysia Development Bhd (1MDB) matters, was called in by the MACC last Wednesday to answer questions about the settlement with IPIC.

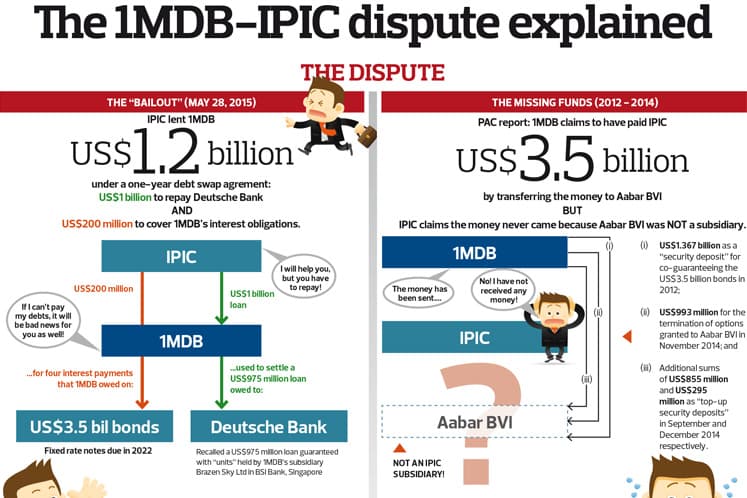

Malaysia and Abu Dhabi were locked in a dispute over US$3.5 billion that 1MDB said was paid to a unit of IPIC — Aabar Investments — between 2012 and 2014.

The matter surfaced in May 2015 when 1MDB was floundering and was not able to service its debts. IPIC entered into a one-year debt swap agreement with 1MDB whereby IPIC was to provide US$1.2 billion in financing to 1MDB, including US$200 million to service interest on bonds that were co-guaranteed with IPIC.

On April 11, 2016, responding to news reports that Aabar had received payments from 1MDB, IPIC released a statement to the London Stock Exchange that Aabar BVI, to which 1MDB had made the payments, was not part of its corporate group and that it had not received any 1MDB money via Aabar BVI.

In June 2016, IPIC filed its consolidated financial statements for the year ending Dec 31, 2015, with the London Stock Exchange. In the financial statements, IPIC indicated that it “understands that other companies outside the group’s corporate structure were incorporated in other offshore jurisdictions using variations of the ‘Aabar’ name. The group is investigating these entities further.” IPIC reiterated that neither it nor Aabar were affiliated with, or received payments from, Aabar BVI.

IPIC also indicated that after 1MDB defaulted on two interest payments due under the 2012 notes in the first half of 2016, IPIC made interest payments totalling US$103 million on 1MDB’s behalf “pursuant to its obligations in respect of the Guarantees”.

The saga started in 2012 when a total of US$3.5 billion from two US$1.75 billion 1MDB bonds arranged by Goldman Sachs were alleged to have been stolen and laundered via Aabar BVI, which has the same name as a company owned by IPIC.

IPIC has said it did not own Aabar BVI although two shareholders — Khadem Abdullah Al Qubaisi and Mohamed Ahmed Badawy Al Husseiny — were also directors of the real Aabar.

1MDB had, in 2012, transferred US$1.367 billion to Aabar BVI as security deposit for the co-guarantee that IPIC provided for the issue of the bonds.

In addition to the US$1.367 billion, according to the Public Accounts Committee of the Malaysian parliament, 1MDB also transferred to Aabar BVI the following sums:

• September and December 2014: US$855 million and US$295 million as “top up of security deposits”.

• November 2014: US$993 million to terminate options that were granted to Aabar to acquire a stake in the listing of power assets owned by 1MDB.

In total, 1MDB paid US$3.5 billion to Aabar BVI between 2012 and 2014.

Malaysia’s and 1MDB’s position has been that the US$3.5 billion was “legitimately” paid to IPIC/Aabar, which then obliges IPC/Aabar to fulfil its obligations as a co-guarantor for the bonds. IPIC/Aabar insisted that it did not receive the money and, therefore, there was no obligation for it to guarantee anything.

Then, in a surprising turn of events, on April 24, 2017, Malaysia entered into a settlement agreement with IPIC, in which it agreed to pay back the US$1.2 billion it owed to IPIC and, more significantly, the Ministry of Finance gave an undertaking that 1MDB would fulfil all future payments of interest and principal sums related to the bonds.

In short, Malaysia agreed to free IPIC of its obligations as a guarantor for which US$3.5 billion was paid by 1MDB between 2012 and 2014.

This decision by the then government led by Najib, who was both prime minister and minister of finance, was a shock because it appears to mean that Malaysia had given up on claiming back the US$3.5 billion that it had earlier insisted was legitimately paid by 1MDB to IPIC/Aabar.

The then minister of finance II Datuk Johari Abdul Ghani said he was not involved in the settlement negotiations. Sources say it was then 1MDB CEO Arul Kanda Kandasamy and special officer to Najib, Datuk Amhari Efendi Nazaruddin, who negotiated with IPIC.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.